Saving money is the keeping or setting aside of a portion of your income after spending and other bills are deducted from earnings for future use. Savings represent money that is otherwise idle and not being put at risk with investments or spent on consumption. Generally saving money refers to the act of setting aside a portion of your income or resources for later use rather than spending it immediately.

This can involve economizing and putting money into a savings account, investing it in assets like stocks or real estate, or simply keeping it in cash. Saving money is like being a smart shopper. It’s all about being frugal with your spending and making sure every penny counts. When you’re budgeting, you’re planning out how to use your money wisely, making sure you have enough for what you need and want, and cost-cutting by finding ways to spend less without sacrificing quality.

10 Simple Ways of Saving Money

1. Determine Your Financial Priority

When you save money, you need to decide what’s most important. This includes making a plan for your money, cutting costs, and being careful about how you spend it. Saving money means economizing and finding ways to spend less and put some money aside for things you need or want in the future. It’s like making sure you’re not spending too much so you can have enough for later on.

2. Set Saving Goals

Setting a saving goal is more like budgeting, because when you budget towards things you have enough to save and it makes it very simple to save money. Budgeting helps your financial planning goals and your expenses are reduced because you’ll now focus on things in your budget, while you pay less attention to things outside your budget and this pattern helps you save more money. Setting a saving goal is a simple way to save money and it’s easy to practice but a bit critical because you might be tempted to go against your goal.

3. Monitoring your Expenses/Spending and Economizing

If you want to develop the saving money habit it is necessary you develop the economizing method. Economizing is about making the most out of what you have. It is about being smart with your spending and finding ways to save money by cutting unnecessary costs or finding cheaper alternatives. So, when you are economizing your expenses you are monitoring and managing, you’re paying attention to what you’re spending and looking for ways to spend less. It’s like being a careful shopper, making sure you get the best value for your money.

4. Meal Prep

Meal prepping can positively impact your savings habit by helping you avoid unnecessary purchases and reducing food waste. To adjust your meal prep to save more easily, consider….Planning your meals like Creating a weekly meal plan, taking into account ingredients you already have and what’s on sale at the grocery store. This prevents overbuying and ensures you use everything you purchase.

Also bought in bulk, Items like rice, beans, and grains can be bought in larger quantities at a lower cost per serving. Lastly, Choose budget-friendly recipes by searching for recipes that use affordable ingredients and are easy to prepare in bulk. Simple dishes like stir-fries, soups, and casseroles are often cost-effective and can be portioned out for multiple meals and most of all, use leftovers creatively. By implementing these strategies, you can optimize your meal prep to align with your savings goals more effectively and it would make it easier for you to save your money.

5. Reduce Your Electric Bills

Most times what would be likely to affect your saving plan is your electricity bill. If you pay more attention to your electricity bills you will notice that much money is spent on electricity because light is something can’t 80% do without. We use electricity for various purposes so we are likely to spend more money on electricity bills. To help you save money, it is best you cut down your electric bills. It is a very easy way to help you save money.

6. Open a Savings Account

While setting your savings goal you can create a savings account to aid the process, a savings account is a special account where you keep your money for a long or short time till when it is needed to be in use. It will help you have extra money in case of an emergency or any other future purpose in life and it will force you to spend less so you can have what to save out of your income.

7. Debt

To easily save you money you need to manage your debt by effectively handling and reducing your debt load. It involves creating a plan to pay off your outstanding debts while reducing interest charges. Debt management means finding ways to handle and reduce the amount of money you owe. It is the making of plans to pay off your debts step by step while trying to pay as little extra money (interest).

Imagine you have a queue of bills to sort out, like for your credit card, school loans, or maybe some medical bills and you start making a smart plan to pay all bills so you can feel more in control of your money. The small but important steps to get rid of your debts and feel better about your finances are an easy way to save money because they make you debt-free.

To manage your debts well, you need to think about your budget, decide which bills to pay first (especially the ones with high-interest rates), and maybe even talk to the people you owe money to see if they can help you out.

8 . Change Your Insurance

When was the last time you reviewed your coverage? You may be spending extra on unnecessary coverage. Changing your insurance can help you save money by making sure you’re only paying for what you need.

Take a good look at what your insurance covers. Sometimes, we pay for things we don’t need or already have covered elsewhere. Don’t stick with the same insurance company out of habit. Look at other options to see if you can get the same coverage for a better price.

You might be surprised at what you find!

If you have multiple types of insurance, like car and home, consider bundling them together with one company. They often offer discounts for bundling, which can save you some cash.

Raise Deductibles Wisely, Your deductible is the amount you pay out of pocket before your insurance kicks in. Raising it can lower your monthly premium, but make sure you can afford the higher deductible if you need to make a claim and also ask for Discounts, Sometimes, you can get discounts for things that will help you save a whole lot of money.

9. Cancel Subscriptions

Saving money means not spending all the money you get. It’s about finding ways to keep more of your money for the future instead of using it all up right away. One way to save money is to stop paying for things you don’t need, like subscriptions for services you hardly use or cutting unnecessary costs wherever possible, whether it’s canceling unused subscriptions or finding cheaper alternatives.

10. Avoid Buying Unnecessary Items

Financial planning is like having a roadmap for your money, setting goals, and making sure you’re on track to achieve them. Monitoring your expenses means keeping track of how much money you spend. It’s like keeping an eye on where your money goes each day, week, or month.

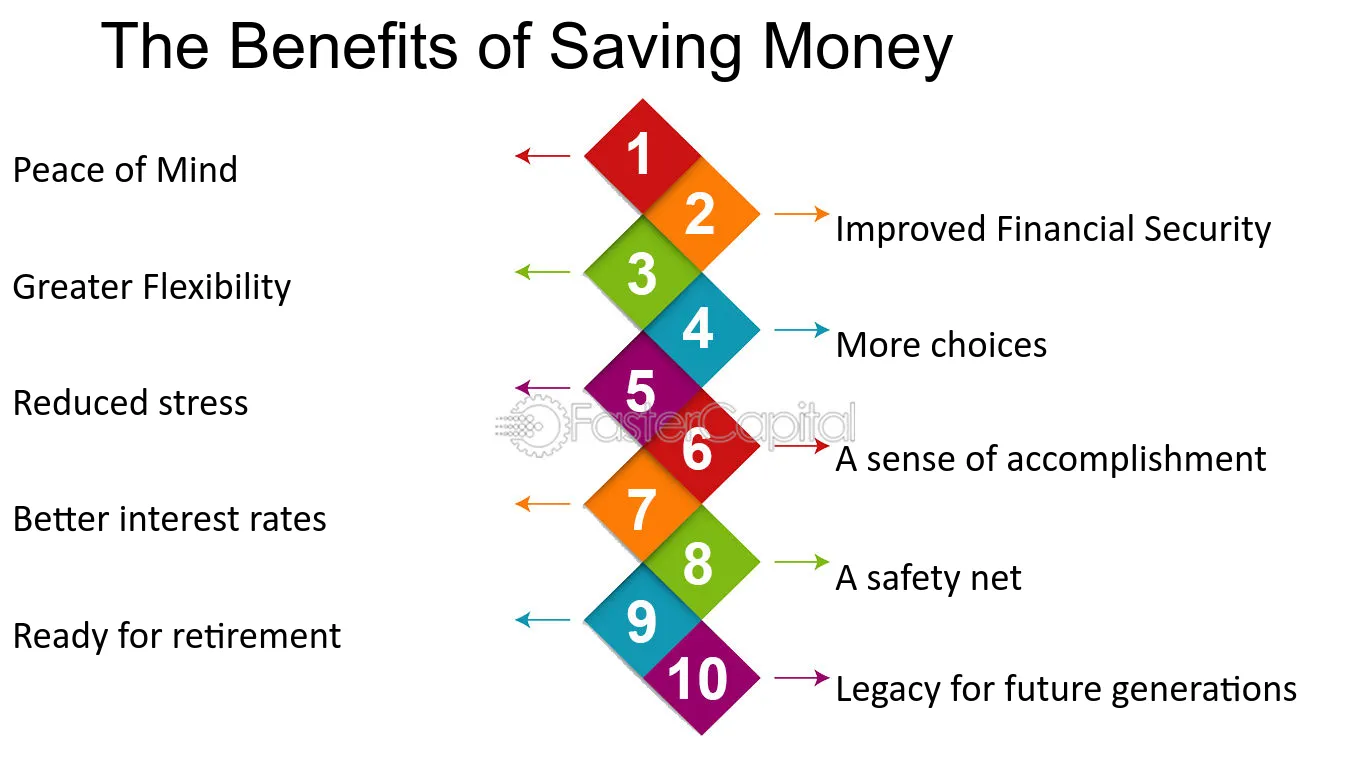

Advantages of Saving Money

1. It Creates Financial Security

Saving money is fundamental to building financial security. It provides a safety net in case of emergencies against unexpected expenses, economic downturns, or life changes such as loss of job or illness. Having savings allows you to weather financial difficulty. It also provides confidence and stability in your financial situation, knowing that you have enough to fall back on if needed.

2. Financial Freedom

Saving money allows you to have more control over your finances, reducing dependence on credit and enabling you to pursue your goals, whether it’s buying a house, traveling, or starting a business.

3. It Gives Peace of Mind

Knowing you have money saved up for the future can alleviate stress and anxiety about financial uncertainties.

Helps in Opportunity Seizing: Having savings empowers you to take advantage of opportunities that arise, such as investment opportunities, educational pursuits, or career changes.

4. It Creates Room for Retirement Planning

Saving for retirement early allows your money to grow over time, ensuring you have enough funds to maintain your desired lifestyle when you retire.

Meeting Future Financial Goals: Saving money enables you to work towards and achieve your future financial goals. Whether it’s buying a home, starting a business, funding education, or retiring comfortably, having savings is crucial. By consistently setting aside money and strategically allocating it towards specific goals, you can make progress and meet your goals.

5. Saving Money Provides You with Emergency Funds

Having funds available for emergencies or unexpected expenses is one of the most immediate benefits of saving money. Life is unpredictable, and unexpected events such as medical emergencies, car repairs, or home maintenance issues can arise at any time. Without savings, these expenses may lead to financial difficulties and even crises, forcing individuals to start borrowing money at high-interest rates or liquidating assets. However, with an emergency fund in place, you can handle such situations with ease and without scattering your overall financial plan.

6. Builds Spirit of Independence

Building up savings gives you the independence to make choices based on your preferences and priorities rather than being forced into decisions due to financial difficulties.

Overall, saving money provides stability, flexibility, and peace of mind, enabling you to achieve both short-term and long-term financial goals

7. You Have Interest and Investment Earnings

By saving money in interest-bearing accounts or investing, you can earn interest or returns on your savings, helping your money grow bigger over time

Summary

Saving money is essential for building financial security, achieving future financial goals, and being prepared for unexpected expenses. It provides a foundation of stability and flexibility that allows individuals to navigate life’s challenges and pursue their aspirations with confidence.

Disadvantages of Saving Money

1. Missing Out

Saving money means you might miss chances to use it for investments or fun things.

2. Money Losing Value

Over time, the money you save might buy less because of prices going up.

3. Small Gains

Putting money in a savings account doesn’t make much more money compared to other ways of investing.

4. Not Ready for Emergencies

If you save all your money, you might not have enough for unexpected situations.

5. Losing Out on Investments

By only saving money, you might not make as much as you could from stocks, bonds, or property.

6. Feeling Stressed

Focusing too much on saving can make you feel like you’re missing out on enjoying life.

7. Limited Income

If you only rely on savings, you might not have enough money for the lifestyle you want or unexpected costs.

Examples of Where You Can Save Money

In the early ages, we do keep money in holes or under the beds and in calabash but the world is now modernized and we have a variety of legal ways how we can save and secure our money till when they are needed. Saving money is the best decision and individuals should implement it, especially for emergency purposes because saving money helps you cross away from difficult situations most times. There are many places where money can be kept or saved but we’ll discuss the most important places where your money can be kept at ease, these include:

1. The Bank

A bank is like a big safe place where you can save your money. It’s not just a place to keep your money safe; it also helps you with things like budgeting and financial planning. You can put your money in a bank account, and it’ll keep track of how much you have saved. Banks can also help you with things like loans and investments.

2. A Piggy Bank (Traditional Box)

It is like a small version of a bank. It’s usually a cute little container that you can put your coins or bills into. Piggy banks are a fun way to save money, especially for kids. They help you learn about money-saving and budgeting from a young age.

3. Akawo

This is a local way of keeping money in someone’s care and recording, is another way people save money. It’s like giving your money to someone you trust to keep it safe for you. They’ll keep track of how much you’ve given them and give it back to you when you need it. This method also involves some level of financial planning and expense reduction, as you rely on someone else to help you manage your funds.

All these methods: banks, piggy banks, and akawo help with money-saving, budgeting, and financial planning. They encourage people to think about how they spend and save their money, which can lead to cost-cutting and economizing in the long run.

Conclusion

When you save money, you’re not just keeping it in a piggy bank or hiding it under your mattress. Instead, you’re putting it somewhere safe where it can grow over time. This could be in a bank account that earns interest, which means the bank pays you a little extra money just to keep your money there. Or you might invest your money, which means you use it to buy things that you hope will increase in value, like stocks or real estate.

The goal of saving money isn’t just to have a pile of cash sitting around. It’s about building up your wealth over time. Wealth is all the valuable things you own, like money, property, and investments. By saving money and making smart choices about how you use it, you’re gradually increasing your wealth and making sure you have enough money to cover your needs in the future. This could be things like buying a house, paying for college, or having enough money saved up for emergencies.

So, saving money isn’t just about saying “no” to spending, it’s about saying “yes” to a more secure financial future. It’s like planting seeds today so you can harvest a bigger crop tomorrow. And the more you save now, the more you’ll have later on when you need it most.