A budget is a plan that helps you manage your money. To create a budget involves how much you earn and spend weekly, monthly, or yearly. It’s like a roadmap for your finances. Creating a budget is important because it aids you in controlling your spending habits, saving for the future, and reaching your desired financial goals like going on vacation, buying a house, planning a party, etc. It also gives you peace of mind by helping you get out of debt and manage unexpected expenses better.

Here’s How to Create a Budget in Seven Steps

To create a budget you need to keep full eyes on your income at hand and the transactions you make. The first thing you should think of when thinking about creating your budget is your income, then Fixed Expenses which are the two main components of a budget, then debt, flexible and Unplanned Expenses, and Savings can then be addressed. Below are the 5 easy ways how to create a budget, they are;

1. Know Your Income

The first step is to find out how much money you make each month from various sources, like your job, side hustles, or investments. Write down all the sources of money and the amount you receive regularly each month. This includes your salary from work, any side hustle earnings, rental income, or any other money you receive on a consistent basis. After listing all your sources of income, add them up to find your total gross income.

Then, subtract any taxes, deductions, or other withholdings to calculate your net income. This is the amount of money you actually take home after taxes and deductions. It’s the money you have available to spend and save each month.

2. Tracking Your Expenses

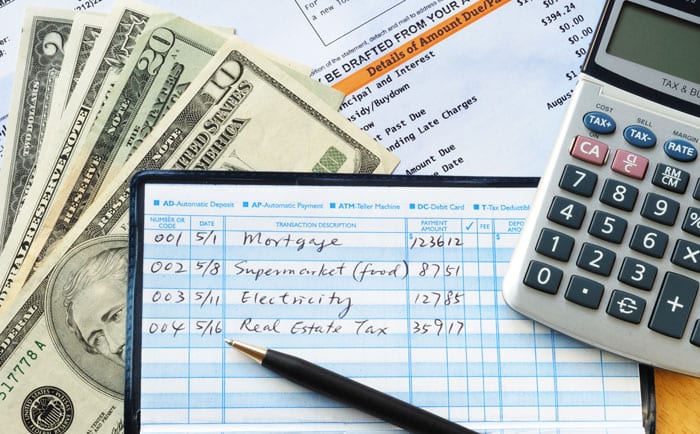

Next, you’ll take a paper and pen, notepad, spreadsheets, or use budgeting apps and make a list of what you spend money on every month. This includes important stuff like paying rent or your mortgage. Rent is what you pay to live in a place you don’t own, while a mortgage is what you pay to own your home. Both are big parts of your budget because they affect how much money you have left for other things. When you budget for rent or mortgage, don’t forget about other costs like

- electricity

- Loan payments (such as student, auto, and personal)

- Travel bills

- Insurance

- Electricity, water, gas

- Phone, internet, cable, and monthly streaming subscriptions

- Child care

- Groceries

- Transportation fares

- Household items

- Dining

- Gym memberships etc

The expenses above are of 3 categories; Fixed expenses: These are regular, predictable expenses that remain constant each month, such as rent or mortgage payments, insurance premiums, and subscription services.

Variable expenses: These are costs that can fluctuate from month to month, such as groceries, utility bills, and transportation expenses.

Discretionary spending: This category includes non-essential expenses, like dining out, entertainment, and shopping for non-essential items. These expenses can be adjusted or cut back on depending on your financial goals. Considering all these expenses helps you plan your money better.

3. Allocating Funds

Managing your money effectively or creating a budget means more than just paying your bills on time. It’s about dividing your funds into categories in a way that aligns with your spending habits and financial plans. Once you have your list of expenses, categorize them into different groups. This will help you see where your money is going and identify areas where you can potentially cut back.

Here’s some advice on how to divvy up your income into categories that work for you: Start by covering your essential expenses like rent or mortgage payments, utilities, groceries, and transportation. These are the must-pay bills that keep your life running smoothly. Allocate a portion of your income towards your financial goals, whether it’s saving for a down payment on a house, building an emergency fund, or investing for retirement. Set specific targets for each goal and contribute regularly to make progress.

4. Subtract Expenses From Income

Budgeting doesn’t have to be complicated. You could also start with subtracting your expenses from your income to create a budget now comes the math part. Subtract your total expenses from your total income. This will give you your discretionary income, which is the money left over after covering all your expenses. If your expenses are less than your income, congratulations! You have a surplus. If your expenses exceed your income, you’ll need to make some adjustments to bring them in line.

5. Adjust Your Budget

If you have a surplus, you can allocate the extra money towards savings, debt repayment, or other financial goals. If you have a deficit, you’ll need to find ways to reduce your expenses or increase your income. Look for areas where you can cut back on spending, like dining out less often or canceling unused subscriptions. You could also consider finding ways to boost your income, like taking on a part-time job or selling unused items.

6: Create a Buffer

It’s essential to build a buffer in your budget for unexpected expenses. Set aside a portion of your income each month for emergencies, like car repairs or medical bills. Aim to have at least three to six months’ worth of living expenses saved up in an emergency fund. This will give you peace of mind knowing you have a financial safety net to fall back on when unexpected costs arise.

7. Make a New Budget Before the Month Begins. (Building Your Budget )

You can make use of the 50/30/20 budget rule, The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

The 50/30/20 rule is a simple way to budget your money. Here’s how it works: Spend 50% of your income on needs like rent, groceries, and bills.

for wants, like going out to eat or buying movie tickets. Save or pay off debt with the remaining 20%. Remember, you can adjust these percentages based on your own situation. If you have high rent, you might need more for needs. If you’re trying to save for a big goal, you might cut back on wants. It’s all about what works best for you!

Ways of Maintaining Your Budget

After you finish creating a budget, the next step is to stick to it. You can hold yourself accountable in a variety of ways. First off, you can set updates with your charge card and financial balances when you arrive at a preset spending sum. You ought to likewise have a go at following each of your costs into your calculation sheet or planning application just after you make a buy. Furthermore, assuming that you share costs with another person, ensure you’re both in total agreement with the spending plan and keep each other on target.

Set Realistic Goals

Before you start sifting through the information you’ve tracked, make a list of your short- and long-term financial goals. Short-term goals should take around one to three years to achieve and might include things like setting up an emergency fund or paying down credit card debt. Long-term goals, such as saving for retirement or your child’s education, may take decades to reach. Remember, your goals don’t have to be set in stone, but identifying them can help motivate you to stick to your budget. For example, it may be easier to cut spending if you know you’re saving for a vacation.

Track Your Spending

Once you’ve created your budget, it’s important to track your spending to ensure you’re staying on track. Keep a record of all your expenses, either using pen and paper or a budgeting app. Review your spending regularly to see where you may be overspending or where you can make adjustments.

Make a Plan

This is where everything meets up: What you’re really spending versus what you need to spend. Utilize the variable and fixed costs you ordered to get a feeling of what you’ll spend before long. Then contrast that with your total compensation and needs. Think about setting explicit and sensible spending limits for every class of costs.

You could decide to separate your costs much further, between things you want to have and things you need to have. For example, if you drive to work consistently, fuel is considered a need. A month-to-month music membership, be that as it may, may be considered a need. This distinction becomes significant while you’re searching for ways of diverting cash to your financial goals.

Adjust Your Spending to Stay on Budget

Now that you’ve outlined your income and expenses, it’s time to make any necessary changes to avoid overspending and make progress toward your financial goals. Start by reviewing your “wants” and see if there are areas where you can cut back. For example, could you have a movie night at home instead of going out? If you’ve already trimmed your wants, take a closer look at your monthly payments. Sometimes, what seems like a “need” might actually be something you can do without.

If you’re still coming up short, consider adjusting your fixed expenses. Are there opportunities to save money by shopping around for better deals on things like auto or homeowners insurance? Remember, these decisions may involve trade-offs, so weigh your options carefully.

Keep in mind that even small savings can add up over time. Making just one minor adjustment at a time can lead to significant extra money in your pocket.

Review your Budget Regularly

Once your budget is set, it’s important to review it and your spending on a regular basis to be sure you are staying on track. A few elements of your budget are set in stone: You may get a raise, your expenses may change or you may reach a goal and want to plan for a new one. Whatever the reason, get into the habit of regularly checking in with your budget following the steps above.

Conclusion

Creating a budget is a simple but powerful tool for managing your finances. Creating a budget is not just about numbers, it’s about taking control of your financial future. By understanding where your money is going and aligning your spending with your goals, you can make informed decisions that lead to financial stability and success. Budgeting empowers you to prioritize what’s important, whether it’s paying off debt, saving for a dream vacation, or building an emergency fund. It’s a tool that gives you the freedom to live the life you want while staying on track with your finances.

By subtracting your expenses from your income, you can gain a clear understanding of where your money is going and make informed decisions about how to allocate it. So follow these steps, start budgeting today, and take the first step and you’ll be well on your way toward a brighter financial future!