Creating a Saving plan is the setting aside of a little portion of your money or resources for a fixed period of time in order to reach a particular financial goal. It is more like setting a goal for your finances. Having a saving plan comes with so many benefits to aid you with your finances.

It helps in resolving emergency monetary issues, creates room for better investment, and cuts expenses. Having a clear plan to achieve financial goals is crucial because it provides direction, helps in setting priorities, and allows for effective resource allocation. It enables you to track progress, stay motivated, and make necessary adjustments along the way. Without a plan, it’s easy to get off track or lose sight of what you’re working towards. Plus, it provides a sense of control and confidence in your financial decisions, leading to better outcomes in achieving your financial goal.

4 Steps in Creating a Saving Plan

Step 1: Set Smart Saving Goals

Smart goals are like a recipe for success when it comes to saving money. Let’s break it down:

Specific: Your goal should be very clear, like saying “I want to save 50 thousand Naira for a new shirt” instead of just “I want to save money.”

Measurable: You need a way to track your improvement, like saying “I’ll save 70 thousand naira in a year” so you can see if you’re on track.

Achievable: Make sure your goal is something you can achieve. It’s better to aim for something you can reach, like saving a bit each month, instead of trying to save a big amount all at once.

Relevant: Your goal should matter to you. It’s like saving for something you really want, like a new house or a new shop, instead of just creating a saving plan for the sake of just saving.

Time-bound: Give yourself a deadline, like saying “I want to save 200 thousand naira by the end of the year.” This gives you a target to work towards and helps you stay focused. Smart saving goals should be set to help create a saving plan.

A smart saving goal means picking a target that makes sense for you and is doable. For example, if you want to buy a new phone, setting a goal to save for it would be a good idea and you should make sure it’s something you can actually meet up with, like maybe saving a certain amount each month until you have enough. It’s like having a map to get to a destination, more like setting financial goals, your goal guides your saving plan.

Step 2: Calculate Your Income/ Savings

First, find out how much money you make each month after taxes. This is your starting point.List all your monthly bills. This includes rent/mortgage, utilities, groceries, transportation, insurance, and any other regular bills. Decide how much you want to save each month. This could be for emergencies, retirement, or any other financial goals you have.

The 50/30/20 Rule: This rule suggests dividing your after-tax income into three categories:50% for Needs: These are essential expenses like rent, groceries, utilities, and minimum debt payments.30% for Wants: This is for non-essential spending like dining out, entertainment, shopping for fun, and hobbies.20% for Savings: This portion goes towards your savings goals, including emergency fund, retirement, and other investments.

Now, see if your current expenses match up with this rule. If not, adjust accordingly. If you’re struggling to save, you might need to cut back on wants or find ways to increase your income. The goal is to make sure you’re living within your means while also saving for the future with a good saving plan,

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. This is called the 50/30/20 rule of thumb, and it provides a quick and easy way for you to budget your money.

The 10% rule is a savings tip that suggests you set aside 10% of your gross monthly income for retirement or emergencies. If you still need to start a savings account, this is a great way to build up your savings. You should create a monthly budget before starting your savings journey.

Step 3: Choose Your Savings Account

High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts. They’re great for parking your emergency fund or saving for short-term goals.

Money Market Accounts: Similar to savings accounts but typically offer higher interest rates. They often come with check-writing privileges and ATM access, making them a bit more flexible.

Certificates of Deposit (CDs): CDs lock your money away for a set period in exchange for a higher interest rate. They’re good for saving for specific goals if you don’t need immediate access to your funds. When choosing an account, consider:

Interest Rate: Look for the highest rate possible to maximize your earnings.

Fees: Check for monthly maintenance fees or transaction fees. You want to minimize any costs eating into your savings.

Minimum Balance Requirements: Some accounts require you to maintain a minimum balance to avoid fees. Make sure it’s something you can comfortably maintain. Ultimately, choose the account that aligns with your savings goals, offers a competitive interest rate, and has minimal fees and requirements.

Step 4: Automate Your Savings

Setting up automatic transfers from your checking to your savings account has some big perks:

- Consistency: It helps you save regularly without even thinking about it. Each month, a set amount of money moves from your checking to your savings automatically.

- Discipline: It removes the temptation to spend that money instead of saving it. Once it’s in your savings, it’s harder to touch without a good reason.

- Progress: Over time, these automatic transfers add up, helping you reach your savings goals faster.

Setting them up is usually easy:

- Online Banking: Log in to your online banking account and find the option for transfers or automatic payments. From there, you can set up the frequency (like monthly) and the amount to transfer.

- Mobile Apps: Many banks have mobile apps where you can do the same thing. Just find the transfer or automatic payments section and follow the prompts to set it up.

Once it’s all set, your bank will handle the rest, moving the money from your checking to your savings according to your instructions.

Maximizing Your Saving Plans

Step 1:Track Your Progress

Keeping an eye on your savings plan is super important. Monitoring your progress helps you see how close you are to reaching your financial goals. It keeps you motivated and focused. If you notice you’re not saving as much as you planned, you can make adjustments. Maybe you need to cut back on spending or find ways to boost your income. You can use certain tools and methods for tracking progress these tools include:

Budgeting Apps: Apps like Mint or YNAB can help you track your spending and savings goals all in one place.

Spreadsheets: Good old-fashioned spreadsheets work too! Create one to track your income, expenses, and savings progress. Now, let’s talk about freeing up more money for savings: Simple changes can add up to big savings. Consider meal planning to cut down on food costs, or review your subscriptions to see if there’s anything you can cancel or downgrade.

Sometimes, you need to bring in more money to save more. Look for side hustles or freelance gigs to supplement your income. You could also try negotiating a raise at your current job if you feel you deserve it.By keeping an eye on your progress, finding ways to cut expenses, and boosting your income, you’ll be well on your way to reaching your saving plan and financial goals!

Step 2: Make a Plan to Achieve Your Financial Goals

Hey there! So, you’ve got some dreams, right? Like buying a cool gadget, going on a vacation, or maybe even owning your own home someday? Well, guess what? You can make those dreams come true with a little thing called a financial plan!

- Figure Out Your Goals: First things first, what do you want to achieve? Write down your dreams, big or small. Maybe it’s saving up for a new phone, paying off student loans, or even retiring comfortably.

- Know Your Money: Take a good look at how much money you’re bringing in and where it’s all going. This means checking out your income (the money you earn) and your expenses (the money you spend). Knowing this stuff helps you see where you can save more.

- Set Up a Budget: Budgeting is like giving every money a job to do. Decide how much you want to save and how much you need for things like rent, food, and fun stuff. Stick to your budget, and you’ll be amazed at how much you can save!

- Save, Save, Save!: Now, it’s time to put your plan into action. Start putting aside some money every time you get paid. Even if it’s just a little bit, every penny counts! You can set up automatic transfers from your checking account to your savings account to make it easier.

- Stay Flexible: There can be unexpected expenses or changes in your income. Don’t worry! Just adjust your plan as needed and keep moving forward. You’ve got this!

Step 3: Sticking to Your Plan

Okay, so you’ve made your plan, but now comes the tricky part: sticking to it! Here’s how you can stay on track:

Stay Focused: Keep your goals in mind and remember why you’re saving. Whether it’s buying a new car or building an emergency fund, having a clear vision will help you stay motivated.

Track Your Progress: Keep an eye on your savings and see how you’re doing. Watching your money grow can be super rewarding and keep you inspired to keep going.

Avoid Temptation: It’s easy to get tempted to purchase the latest tech gadget. But remember, every money you spend now is one less dollar towards your goals. Think twice before making any purchases.

Celebrate Small Wins: Saving money is hard work, so don’t forget to celebrate your successes along the way! Treat yourself to something small when you reach a milestone, like hitting a savings goal or sticking to your budget for a month.

Stay Positive: Creating a Saving plan can be tough sometimes, but stay positive and keep pushing forward. Remember, every little step you take gets you closer to your dreams! With a solid saving plan and a little determination, you can achieve anything you set your mind to.

Types of Saving Plan

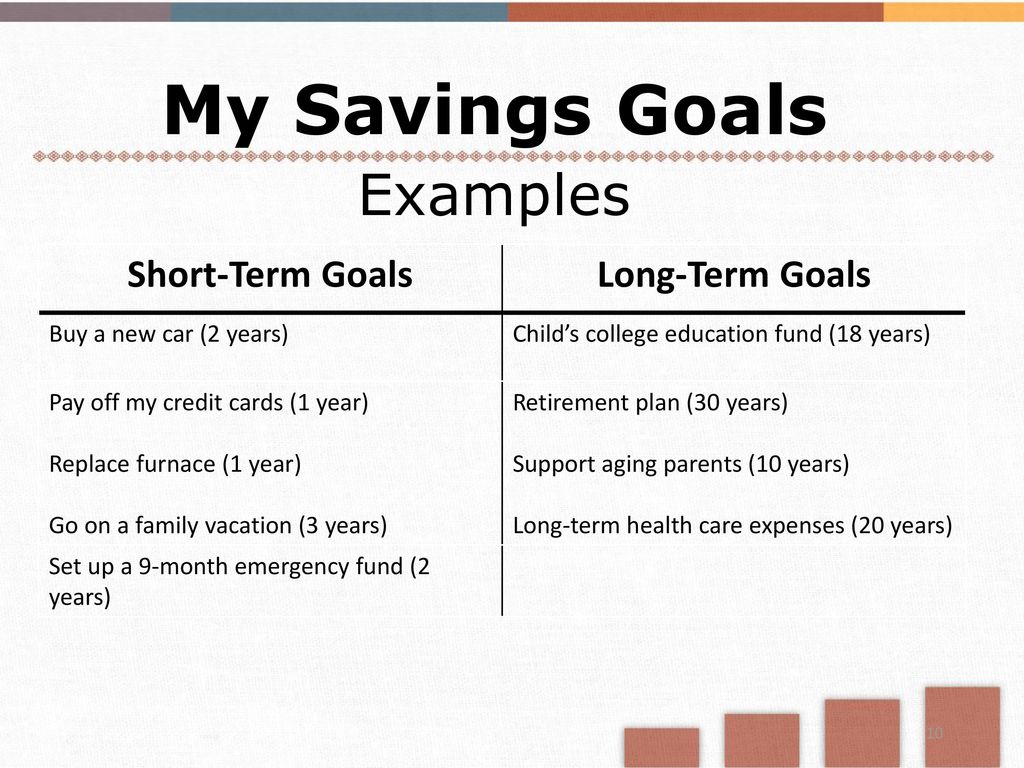

1. Short Term Saving Plan

Think of short-term saving like saving up for something you want to buy soon or preparing for unexpected expenses. Short-term savings plans are designed to meet financial goals within a relatively brief given time, typically within a year or less than a year. Some strategies to consider are:

Automatic Deposits: This is like putting aside a small part of your paycheck each month into a special savings account. It’s like setting aside money for a rainy day.

Investing a Portion: You could also choose to invest some of your money. This means putting your money into things like stocks or bonds with the hope that it will grow over time. It’s like planting seeds and waiting for them to grow into trees that give you more fruit.

Balancing Savings and Investment: You can balance your savings and investments by splitting your money between them. For example, you could save some and invest some, so you’re prepared for both short-term needs and long-term growth.

Emergency Fund: Building an emergency fund is a critical component of any short-term savings plan. Aim to save enough to cover three to six months’ worth of living expenses. This fund provides a financial safety net in case of unexpected expenses or loss of income.

Budgeting: Creating and sticking to a budget is essential for managing short-term savings effectively. By

Investing a Bit: Instead of

you might want to invest some of your money to make it grow faster. It’s like planting seeds that will grow into bigger plants over time. You could decide to put aside 10% to 15% of your money into investments like stocks or bonds.

Splitting Evenly: Another way to do it is to divide your money evenly between saving and investing. So, you could put 10% into your savings account and use the other 10% for investments.

Long-term saving is like creating a Saving plan towards big things in the future, like buying a house or retiring comfortably. Examples of what you can save long-term for are;

2. Long-Term Savings Plan

Saving for Retirement: This is a big one. You want to make sure you have enough money to live comfortably when you’re older. So, you might start putting money into a retirement account so you can enjoy its shade later.

Investing for the Future: Instead of just saving, you can invest your money in things like stocks, bonds, or real estate. This way, your money has the chance to grow a lot over many years. It’s like putting money into a piggy bank that grows bigger over time.

Education Savings: If you want to go to college or if you have kids who will, it’s smart to start saving early. You could put money into a special account just for education expenses, like a 529 plan. It’s like filling up a jar with coins now so you can use them for school later.

Regular Check-ins: It’s important to keep an eye on your long-term savings and make adjustments as needed. Life changes, and so do your goals and priorities. So, every once in a while, take a look at your savings plan and make sure it’s still working for you.

By following these simple steps for short-term and long-term saving plans, you can start building a solid financial foundation and reach your goals over time.

Conclusion

Having a savings plan is like having a map for your money. It helps you know where your money is going and how much you can save for the future.

When you achieve your savings goals, it can bring peace of mind and freedom. You’ll be prepared for emergencies, big purchases, or even retirement. Plus, having savings can reduce stress and give you more control over your finances.

Start by setting clear goals and creating a budget. Track your expenses and look for areas to cut back. Then, automate your savings by setting up automatic transfers to your savings account.

Helpful resources for creating a savings plan include budgeting apps like Mint or staying tuned on our financial planning website, and reading books like “The Total Money Makeover” by Dave Ramsey or “I Will Teach You to Be Rich” by Ramit Sethi. These tools can guide you through the process and make it easier to stick to your plan.